Term Life Insurance in Orange County, CA

What is the best term life insurance in Orange County?

At Pacific Direct Insurance, we specialize in providing affordable, customizable term life insurance options designed specifically for the unique needs of Orange County residents. Whether you're in high-cost suburbs like Irvine, Anaheim, Newport Beach, Laguna Beach, or Yorba Linda, our policies help protect your family's future by covering essentials such as mortgages, education expenses, daily living costs, and even potential income loss in this expensive region. With rates starting as low as $26 per month for $500,000 in coverage (based on 2025 averages for a healthy 35-year-old non-smoker, per NerdWallet), we make robust protection accessible and straightforward. As an independent broker, we compare quotes from top-rated carriers like Prudential, Banner Life, Protective, Guardian, and Lincoln Financial to find the perfect fit for your lifestyle and budget. Visit us at our convenient location: 2230 W Chapman Ave, Ste. 235, Orange, CA 92868, or call 714-941-0234 today for a personalized, no-obligation free quote.

Benefits of Term Life Insurance in Orange County

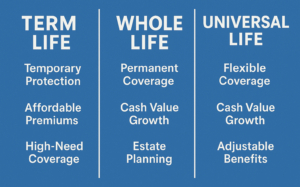

Infographic showing term life benefits for Orange County residents.

Why should you consider buying term life insurance in Orange County?

With a population exceeding 3 million and median home prices around $1.2 million as of June 2025 (per Zillow), financial security is more crucial than ever for families navigating this competitive market. Term life insurance offers inexpensive, temporary coverage that aligns perfectly with key life stages, such as paying off a mortgage, funding college tuition during child-rearing years, or bridging gaps until retirement savings mature. It's ideal for replacing lost income if the unthinkable happens, ensuring your loved ones can maintain their lifestyle in one of Southern California’s priciest areas without facing foreclosure or downsizing. According to the LIMRA 2025 Insurance Barometer Study, term life remains the choice for a majority of policyholders—over 80% in some demographics—due to its affordability, simplicity, and lack of investment components that can complicate permanent policies.

Key benefits include:

- Affordability: Premiums are a fraction of whole life costs, often 5-10 times lower, allowing you to secure high coverage amounts (e.g., $1M+) without straining your budget—perfect for Orange County’s elevated living expenses where housing alone can consume 40% of income.

- Flexibility: Choose terms from 10 to 30 years to match your needs, like covering a 20-year mortgage or until kids graduate from top Southern California universities like UC Irvine.

- Peace of Mind: Protects against financial burdens in a high-cost area where average household incomes are around $110,000 but costs for housing, education, and healthcare continue to rise annually.

- Tax-Free Payouts: Beneficiaries receive the death benefit without income tax, maximizing support for your family in California’s progressive tax environment.

- Convertible Options: Many policies allow conversion to permanent coverage later without a new medical exam, adapting to changing needs as you build wealth in Orange County’s booming real estate market.

- Custom Riders: Add options like accelerated death benefits for terminal illness payouts or child protection riders to extend coverage to dependents, tailoring the policy for family-focused Orange County residents.

- Level Premiums: Lock in rates that don’t increase during the term, providing budget stability amid fluctuating costs like property taxes in areas such as Newport Coast.

How Much Does Term Life Cost in Orange County?

What is the average cost of term life insurance in Orange County?

For a healthy, non-smoking 35-year-old, a $500,000 policy with a 20-year term typically ranges from $26-35 per month, depending on gender, health, and carrier (updated July 2025 rates from NerdWallet and MoneyGeek). Local factors like Southern California’s overall health trends, lifestyle risks (e.g., long commutes on congested freeways like the 405), and environmental concerns such as wildfire exposure in hillside communities can slightly influence premiums. However, as local experts, we optimize by shopping multiple carriers to secure the lowest rates tailored specifically to Orange County residents, often beating national averages by 10-20% through volume discounts and preferred partnerships.

Use this to estimate your premium:

Factors affecting costs include age, health status, smoking habits, occupation (e.g., higher for first responders in Santa Ana), and recreational hobbies like surfing in Huntington Beach—we can help refine this for your specific situation with our personalized consultations.

How to Buy Term Life Insurance in Orange County

How do you buy term life insurance in Orange County?

It’s a straightforward, efficient process with Pacific Direct Insurance guiding you every step of the way. As local experts deeply familiar with Orange County’s unique market dynamics—from skyrocketing property values in Yorba Linda to the family-focused needs of suburban areas like Huntington Beach and Fountain Valley—we ensure a seamless, hassle-free experience customized to your circumstances. Here’s a detailed, step-by-step guide to get you started:

- Assess Your Needs: Begin by evaluating your financial obligations, including income replacement for 10-15 years, outstanding debts like mortgages or car loans, and future expenses such as college tuition at local institutions or retirement contributions.

- Calculate Coverage Amount: Use the standard formula: (10-15 × Annual Income) + Outstanding Debts + Future Expenses - Existing Assets. For an Orange County family earning $150,000 annually with a $1.2M mortgage and minimal savings, this might translate to $1.5M-$2.5M in coverage to fully account for local costs like high property taxes and childcare.

- Research and Get Multiple Quotes: We compare over 30 top carriers, factoring in Orange County-specific elements like earthquake risks, high healthcare costs, or even proximity to fire zones in places like Laguna Hills, to find the best rates, terms, and riders.

- Complete Application and Medical Exam: Submit basic info online or via phone; then, undergo a quick, often at-home medical exam to assess your health. Underwriting typically takes 2-4 weeks, with accelerated no-exam options available for healthy applicants under certain limits.

- Review and Activate Your Policy: Once approved, review the policy details, sign electronically, and activate coverage—many policies offer instant temporary binders or guaranteed issue for smaller amounts to provide immediate protection.

- Ongoing Review: We recommend annual check-ins to adjust for life changes, such as a new home purchase in Irvine or the birth of a child, ensuring your coverage evolves with you.

Orange County Case Studies

Case Study 1: The Johnson Family in Irvine

Meet the Johnsons, a 38-year-old couple from Irvine with two young children and a combined income of $180,000. They approached Pacific Direct Insurance in early 2025 concerned about their $1.3 million mortgage and future education costs for their kids at top Southern California schools.

- Situation: High mortgage debt, young dependents, and a need for income replacement in a high-cost area.

- Solution: We secured a $750,000, 25-year term policy with Banner Life, including a child rider for added protection.

- Outcome: Monthly premium of just $32, saving 25% vs. direct quotes; full coverage for home loan and college savings, providing peace of mind.

Case Study 2: Sarah, Single Mother in Anaheim

Sarah, a 42-year-old single mother in Anaheim working in healthcare, needed affordable protection for her teenage daughter amid a modest $800,000 home and lingering student loans.

- Situation: Single income, health-related occupation risks, and focus on daughter’s future security.

- Solution: A $500,000, 15-year term policy through Protective Life at $28 per month, with adjusted rates for her shift work and a spousal-equivalent rider for her child.

- Outcome: Budget-friendly coverage that fits her lifestyle, allowing focus on family time; navigated health risks seamlessly for preferred rates. Sarah now enjoys worry-free protection near local attractions like Disneyland.

Case Study 3: The Ramirez Couple in Newport Beach

The Ramirezes, a 45-year-old dual-income couple in Newport Beach with no children but significant estate planning needs, sought term coverage to bridge until retirement.

- Situation: High-net-worth with a $2M home, variable tech industry income, and desire for temporary protection against income loss.

- Solution: We arranged a $1M, 20-year convertible term policy with Guardian, including accelerated death benefits for flexibility.

- Outcome: Premium of $45/month, convertible to whole life later; secured their luxury lifestyle and assets, with annual reviews to adapt to market changes.

Term Life vs Other Types in Orange County

Chart comparing life insurance types in Orange County

Is term life insurance better than whole life in Orange County?

The answer depends on your financial goals, life stage, and long-term plans. In Orange County’s affluent yet expensive market—where home values average $1.2 million and families often juggle high mortgages with saving for retirement—term life excels for affordable, temporary protection during peak-need periods like raising children or paying down debt. Whole life, on the other hand, provides permanent coverage with cash value accumulation, making it suitable for estate planning among high-net-worth individuals in exclusive enclaves like Coto de Caza or Dana Point. Universal life offers even more flexibility with adjustable premiums and benefits, ideal for those with variable incomes in Southern California’s tech, entertainment, or real estate sectors.

| Term Life | Low | Affordable coverage for families and mortgage protection | Temporary (10-30 years) |

| Whole Life | High (5-10x term rates) | Lifelong coverage and estate planning for high-net-worth individuals | Lifelong |

| Universal Life | Variable | Flexible option for changing financial needs over time | Lifelong (adjustable) |

For a full comparison, read our Life Insurance Overview.

Common Questions About Term Life in Orange County

Secure Your Term Life Insurance in Orange County Today

Ready to protect your family with tailored, affordable term life insurance? Contact Pacific Direct Insurance now—call 714-941-0234 or stop by 2230 W Chapman Ave, Ste. 235, Orange, CA 92868. As your trusted local experts at pacificdirectinsurance.com, we’re committed to finding the best coverage at the lowest rates for Orange County residents, backed by years of experience and A+ rated carriers.

Explore more: