GET A QUOTE AT NO COST.

714-941-0234

This Week Only: Get a Quote, Book a Call, and Claim a $15 Amazon

or Starbucks Gift Card.

Simple. Straightforward. Honest Quotes.

WE SHOP ALL MAJOR CARRIERS FOR YOU

Affordable Term Life Insurance in Orange County & Southern California: Expert Options for Families, Seniors, and More in 2025

What is term life insurance in Orange County?

Term life insurance provides coverage for a fixed period (10-30 years), paying a death benefit if you pass away during the term—ideal for protecting families against SoCal's high living costs like mortgages and education. At Pacific Direct Life Insurance, we specialize in affordable term life, shopping top carriers for rates starting $20-30/month for $500K.

Located at 2230 W Chapman Ave, Ste. 235, Orange, CA 92868—call 714-941-0234 for a free quote.

Benefits of term life for affordable family protection in Orange County.

Benefits of Term Life Insurance in Orange County

Why get term life insurance in Orange County?

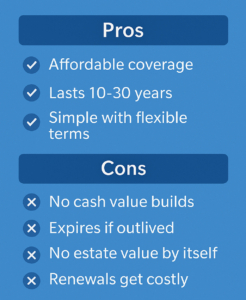

With median home prices over $1M, term life offers cheap protection for mortgages and income replacement. 80% choose term for affordability—up to 15x cheaper than permanent. Pros: Low costs, high coverage. Cons: No cash value, expires if outlived.

How Much Does Term Life Cost in Orange County?

What is the average cost of term life insurance in Orange County?

For a healthy 35-year-old, $500K coverage with a 20-year term averages $20-30/month, varying by age/health. We find the best rates for locals.

How to Buy Term Life Insurance in Orange County

How do I buy term life insurance in Orange County?

1. Calculate Needs: Coverage = (10-15 x Income) + Debts - Assets. Or, use our tool here.

2. Get Quotes: We compare 30+ carriers like Banner Life.

3. Medical Exam: Typically needed; no-exam options available.

4. Underwriting: Informal checks for approval.

5. Activate: Coverage starts fast.

Case Study: Affordable Coverage for an LA Family with Health Challenges

- Client Profile: A Los Angeles family seeking life insurance despite existing health issues.

- Challenge: The family faced difficulty finding affordable coverage due to health-related underwriting concerns, while still needing significant financial protection for income replacement and mortgage security.

- Solution: Pacific Direct Insurance identified a carrier with lenient underwriting guidelines and competitive rates:

- Secured $750,000 in term life coverage

- Premium cost: $35/month

- Policy tailored for financial stability and family protection

- Results:

- Affordable coverage despite health challenges

- Significant financial protection for mortgage and income replacement

- Peace of mind for the family with reliable coverage

Takeaway:

Even with health concerns, the right approach and carrier selection can secure substantial coverage at a budget-friendly price.

Term Life vs. Other Types

Is term life better than whole life in Orange County?

Term is affordable for temporary needs; whole builds cash value but costs more.

| Term | Low | Temporary protection |

| Whole | High | Permanent, cash value |

| Universal | Variable | Flexible coverage |

2025 Term Life Insurance Trends: Opportunities for Affordable Coverage in Southern California

According to LIMRA's 2025 data, term life insurance maintains steady demand, with overall U.S. individual life sales setting records at $15.9 billion in 2024 and expected 1-5% growth in whole life influencing the market. However, term's appeal lies in its simplicity and low premiums, ideal for temporary needs like child-rearing or mortgages. In Southern California, where high living costs (average OC income ~$90K per U.S. Census 2025) amplify financial pressures, term policies offer income replacement at fractions of permanent options. LIMRA notes young adults (under 30) overestimate costs by 1012%, contributing to the 102 million underinsured adults. Digital trends, including no-medical-exam options (surging due to convenience), are reducing barriers—perfect for busy professionals in Irvine or seniors in Newport Beach facing health challenges like high BMI or diabetes. As an independent broker, we leverage these trends to deliver savings of 15-25%, educating clients to overcome misconceptions as per the 2025 Barometer Study's focus on consumer insights. External resource: LIMRA 2025 Barometer Study.

Why Choose Term Life Insurance with Pacific Direct Insurance

Term life provides pure protection without cash value, making it the most affordable way to safeguard your family's future. Drew Napolin, CLU, explains: "In Orange County's competitive landscape, term life covers essentials like mortgages ($1M+ medians) at $20-30/month for healthy adults." We specialize in convertible terms (to permanent later) and no-exam policies up to $500K, targeting long-tails like "how to get term life insurance without exam in Anaheim CA for variable income." Our independence means unbiased comparisons, unlike captive agents. With LIMRA 2025 highlighting 59% of non-owners intending to buy but delaying due to complexity, we simplify with free analyses via our calculators (recommend 10-15x salary + debts).

Exploring Term Life Insurance Options for Orange County Residents

We offer level term (fixed premiums) for 10, 20, or 30 years, ideal for families covering education (UCI ~$15K/year) or mortgages. No-exam variants from Symetra suit seniors or those with "term life insurance for high BMI in Huntington Beach CA." Benefits: Low cost, high coverage; Drawbacks: Expires without payout if outlived. Per LIMRA 2025, term sales remain stable as consumers seek value amid economic shifts.

Level Term Life: Stable Protection for Families

Fixed rates for the term, perfect for young parents in Irvine needing "affordable term life insurance for families in Orange County CA." Example: $500K/20-year at $25/month. Convertible to whole later.

No Medical Exam Term Life: Quick Coverage for Seniors and High-Risk

Approval in days without exams, targeting "affordable term life insurance for seniors in Orange County CA no medical exam." Suited for retirees in Newport Beach with diabetes; rates start at $15/month for $100K.

Return of Premium Term: Added Value for Long-Term Holders

Refunds premiums if outlived term—great for health-conscious clients in Laguna Beach. Slightly higher cost but aligns with 2025 trends toward value-driven products per LIMRA.

| Type | Duration | Est. Cost ($500K, 40yo Male) | Best For |

|---|---|---|---|

| Level Term | 10-30 years | $20-30/mo | Families, mortgages in OC |

| No Exam Term | 10-20 years | $25-40/mo | Seniors, health issues |

| Return of Premium | 20-30 years | $40-60/mo | Long-term value seekers |

Serving Key Areas: Customized Term Life in Southern California

From Irvine's tech families to Long Beach's workers, we address local risks like wildfires. Explore: Orange County, Los Angeles. Blogs: Term Guide, No Exam Seniors.

Client Success Stories: Real Protection in Action

"Drew found affordable no-exam term despite my BMI—peace for our Anaheim family!" – Sarah P. "Term life at $22/month covered our Irvine mortgage perfectly." – Mike T. "Convertible term for our growing household in Huntington Beach—saved hundreds." – Lisa M. "Quick approval for seniors in Newport—highly recommend!" – Robert S.

Frequently Asked Questions About Term Life Insurance in Orange County (2025)

What is term life insurance?

Temporary coverage (10-30 years) at low cost, no cash value—ideal for income protection.

How much does term life cost in Orange County?

$20-30/month for $500K, varying by age/health—use our calculator.

Can I get term life without a medical exam?

Yes, up to $500K—perfect for "affordable term life insurance for seniors in Orange County CA no medical exam." Read blog.

What's the best term length?

20-30 years for families; 10 for short needs. See guide.

Term vs whole life: Which is better?

Term for affordability; whole for lifelong. Compare in overview.

Can term life be converted?

Yes, to permanent without exam—great for evolving needs.

Term life for high-risk in OC?

We find options for diabetes, BMI—contact us.

2025 term trends?

Stable sales, no-exam growth per LIMRA—affordable amid cost overestimations.

Ready? Free Quote. More: FAQ or 2025 CA Guide. External: Forbes Term Life.

{

"@context": "https://schema.org",

"@type": "Service",

"serviceType": "Term Life Insurance",

"provider": {

"@type": "LocalBusiness",

"name": "Pacific Direct Insurance",

"url": "https://www.pacificdirectinsurance.com/",

"telephone": "714-941-0234",

"address": {

"@type": "PostalAddress",

"streetAddress": "2230 W Chapman Ave, Ste. 235",

"addressLocality": "Orange",

"addressRegion": "CA",

"postalCode": "92868",

"addressCountry": "US"

}

},

"areaServed": {

"@type": "AdministrativeArea",

"name": ["Orange County", "Southern California"]

},

"description": "Affordable term life insurance options in Orange County and Southern California, including no medical exam policies for families and seniors.",

"offers": {

"@type": "Offer",

"priceCurrency": "USD",

"price": "20",

"itemOffered": "Term Life Insurance Policy",

"availability": "InStock"

},

"aggregateRating": {

"@type": "AggregateRating",

"ratingValue": "4.8",

"reviewCount": "100"

}

}

Common Questions About Term Life Insurance

Secure Term Life Insurance Today

Ready for term life in Orange County?

Contact us at 714-941-0234, fill out the form below, or visit 2230 W Chapman Ave, Ste. 235, Orange, CA 92868.

Explore:

Whole Life | Universal Life | Orange County Location