Universal Life Insurance in Orange County & Southern California

What is universal life insurance?

Universal life insurance is a flexible permanent policy that offers lifelong coverage with adjustable premiums and cash value growth linked to interest rates, perfect for adapting to life's changes in dynamic areas like Orange County and Los Angeles. At Pacific Direct Life Insurance, we help SoCal residents customize universal life from top carriers for investment potential and security. Rates vary $100-500/month for $500K, with flexibility. We're located at 2230 W Chapman Ave, Ste. 235, Orange, CA 92868—call 714-941-0234 for a free quote.

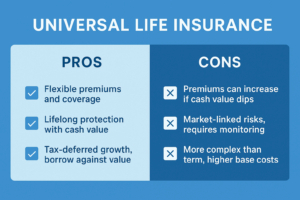

Key benefits and drawbacks of universal life insurance for Orange County and LA, with adjustable premiums.

Benefits of Universal Life Insurance in Southern California

Why choose universal life insurance in Orange County?

It provides permanent protection with the ability to adjust premiums and death benefits, ideal for variable incomes in LA's economy or growing families in SoCal. Build cash value for loans or withdrawals—tax-deferred.

Universal appeals to those needing adaptability, about 10-15% of buyers.

How Much Does Universal Life Insurance Cost in Orange County?

What is the cost of universal life insurance in Southern California?

Rates are variable based on contributions, interest, and fees—typically $100-500/month for $500K at age 35. We optimize for low fees. Get your term life estimate on our tools page, then use it to calculate whole and/or universal coverage below.

How to Buy Universal Life Insurance in Orange County

How do I buy universal life insurance in Southern California?

1. Assess Needs: Coverage = Net Worth + Future Expenses - Assets.

2. Get Quotes: Compare indexed or variable universal from carriers like Protective.

3. Medical Exam: Usually required.

4. Fund Cash Value: Choose investment options.

5. Policy Issuance: Flexible adjustments ongoing.

Case Study: Flexible Coverage for an LA Entrepreneur with Fluctuating Income

- Client Profile: Los Angeles-based entrepreneur seeking a life insurance solution that adapts to income changes while providing strong financial security.

- Challenge: The client needed significant protection but required premium flexibility due to variable business income, making traditional whole life or rigid term policies less practical.

- Solution: Pacific Direct Life Insurance recommended a Universal Life Insurance policy designed for adaptability:

- Coverage Amount: $800,000

- Average Premium: $200/month

- Policy structure allowed premium adjustments while maintaining long-term coverage

- Results:

- Secured lifetime protection tailored to the client’s financial goals

- Provided flexibility to increase or reduce payments based on cash flow

- Created a policy with cash value growth for additional financial leverage

Takeaway:

Universal life insurance offers an ideal solution for entrepreneurs with variable income, blending coverage stability with financial flexibility.

Universal Life vs. Other Types

Is universal life better than whole in Orange County?

Universal offers flexibility in premiums, while whole has fixed rates; term is cheaper but temporary.

| Universal | Variable | Flexible needs |

| Whole | Fixed high | Stable cash value |

| Term | Low | Temporary |

Common Questions About Universal Life Insurance

Secure Your Universal Life Insurance Today

Ready for universal life in Orange County? Contact us at 714-941-0234, fill out the form below, or visit 2230 W Chapman Ave, Ste. 235, Orange, CA 92868.

Explore: