How to Buy Term Life Insurance in California: A Step-by-Step Guide for Orange County Families

What is the best way to buy term life insurance in California? If you’re an Orange County family navigating high living costs like $1M+ home prices, buying term life insurance can provide affordable protection for mortgages, income replacement, education expenses, and more. This comprehensive step-by-step guide from Pacific Direct Insurance covers everything from assessing needs to securing your policy. As an independent broker led by Drew W. Napolin, CLU—a Chartered Life Underwriter with over 25 years of experience—we shop 30+ top carriers like Protective Life, Symetra, Pacific Life, Banner Life, and Prudential—often averaging $26/month for basic coverage in 2025 (per NerdWallet 2025 average life insurance rates). Located at 2230 W Chapman Ave, Ste. 235, Orange, CA 92868, call 714-941-0234 for a free quote or visit our services page. The 2025 LIMRA Insurance Barometer Study reveals 50% of U.S. adults own life insurance, but 42% need more (102 million underinsured), with families in high-cost areas like OC delaying due to cost misconceptions (overestimated 10x).

Orange County family reviewing term life insurance options for financial security

Understanding Term Life Insurance in California: What It Is and Why Families Need It

What is term life insurance and why buy it in California?

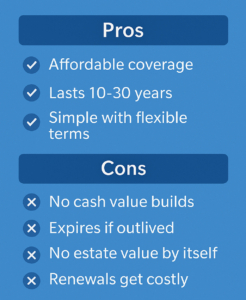

Term life is a simple, cost-effective policy that provides coverage for a set period (typically 10-30 years), paying out a death benefit if you pass away during the term. It has no cash value accumulation, making it pure protection—perfect for young families in Orange County facing education costs ($50K/year average per College Board 2025 trends) or LA commutes that increase risk factors. In 2025, average rates are $26/month nationwide, but CA-specific factors like health regulations (e.g., stricter underwriting for pre-existing conditions per CA Dept. of Insurance) can affect pricing—80% of buyers choose term for its affordability (per NerdWallet 2025).

- Pros: Low premiums (often 10-20x cheaper than whole life), high coverage amounts ($250K-$1M+), and flexibility with riders like child protection.

- Cons: Expires without payout if outlived, and renewal skyrockets (up to 5x higher per Policygenius 2025).

For OC families, term covers temporary needs like mortgages ($4K/month average) or income replacement (10-15x salary recommended). LIMRA 2025 notes stable term sales (1-3% growth forecast) amid overall premiums at $16.2 billion (up 4%), with 59% of non-owners intending to buy but delaying due to misconceptions. In SoCal, trends like no-medical-exam options (up 20% demand) make term accessible for health-challenged families.

Step 1: Determine If Term Life Is Right for You and Your Family

Is term life the best choice for Orange County residents?

If you need temporary coverage (e.g., until your mortgage is paid or kids are independent), yes—it’s cheaper than whole or universal life, which build cash value but cost 5-10x more (per Bankrate 2025). Compare types on our overview. For health issues like diabetes (12% prevalence in OC per CDC 2025), we match lenient carriers with no-exam options (20% demand surge per LIMRA 2025). Consider your life stage: Young families in Irvine (median age 34) benefit from 20-30 year terms for child-rearing, while mid-career professionals in Laguna Beach may add convertible riders to switch to permanent later. Assess risks: OC’s wildfire exposure (30% claim increase per Insurance Journal 2025) or commute hazards in LA. If permanent coverage fits, explore whole life. Use our tools to decide. Factors to consider: If you have pre-existing conditions, term with no-exam might be ideal (rates 20-50% higher but approval in days, per Policygenius 2025).

Step 2: Calculate Your Coverage Needs Using the DIME Formula

How much term life do I need in California?

Use the DIME formula: Debt + Income + Mortgage + Education.

Step-by-step math:

- 1) Debt: Sum all liabilities (loans, credit cards—average OC debt $50K per Experian 2025).

- 2) Income: Multiply annual salary by years to replace (10-15x, e.g., $100K x 12 = $1.2M).

- 3) Mortgage: Add remaining balance ($600K average in OC).

- 4) Education: Estimate per child ($200K for 4 years at UCI).

- Total: Subtract existing assets (savings, investments).

Advanced calculation:

Adjust for CA-specific taxes (estate over $13M at 16%) or wildfire rebuilding costs ($300K average per Insurance Journal 2025). For families with pre-existing conditions, factor medical debts ($12K/year average per KFF 2025).

Benefits of term life for affordable family protection in Orange County.

Step 3: Research Term Life Options and Trends in California

What term life options are available in California?

Level term (fixed rates, 10-30 years, $20-30/month for $500K per NerdWallet 2025), renewable (extend yearly, rates rise), convertible (switch to permanent without exam), and return of premium (refund if outlived, $40-60/month). CA law requires transparency on fees and 10-day free look (CA Dept. of Insurance 2025). For 30-year term, averages $43-123/month, with no-exam up 20% (LIMRA). Trends incluide stable sales (1-3% growth), digital buying (32% preference), and health-focused underwriting (e.g., for diabetes, 12% in OC per CDC). We recommend 20-year for most families, convertible for flexibility. Explore our term services.

Additional options:

Group term through employers (less underwriting, up to $50K free per SHRM 2025), or joint term for couples (10-20% savings per MoneyGeek 2025). For high-risk families (e.g., wildfire-prone areas in OC), add accelerated death riders.

Step 4: Get Multiple Quotes from Independent Brokers

How to get term life quotes in Orange County?

As independents, we compare carriers like AAA ($69/month for 60-year-old male $100K/10-year per AAA 2025 rates), Banner Life, and Pacific Life—provide age, health, coverage for instant estimates—saving 15-25% vs captive agents (per Consumer Reports 2025). Avoid single-carrier agents; independents like us access diverse options. Online tools like ours give preliminary quotes, but personalized consultation factors in OC-specific health (e.g., wildfire-related respiratory issues). LIMRA 2025 notes 59% delay due to complexity—our no-pressure process simplifies it. Tips: Get 3-5 quotes, consider A+ rated carriers (AM Best 2025), and factor riders (child rider $5/month).

Underwriting process for term life insurance in California

Step 5: Navigate Underwriting and Medical Exam Requirements

What is underwriting for term life in California?

Carriers review health, occupation, and hobbies for rate class (preferred/standard, per AM Best 2025). Medical exam (blood/urine, 30-60 minutes) is common for $250K+ coverage; no-exam options (up to $500K) cost 20-50% more but approve in days (Policygenius 2025). CA privacy laws (CCPA) protect data—be honest to avoid denials (rescission possible within 2 years). For high-risk health (diabetes in 12% of OC adults), we find lenient carriers. Tips: Improve health pre-exam (lower BMI for better rates, per CDC 2025). If exam-free needed, explore our no-exam guide.

-

- Underwriting timeline: 4-6 weeks standard, 1-2 weeks no-exam.

- Factors affecting rates: Smoking (doubles costs), family history, hobbies (e.g., scuba diving in OC adds 10-20%).

Step 6: Choose, Purchase, and Customize Your Policy

How to choose the best term life policy in CA?

Evaluate rate, carrier rating (A+ AM Best for financial stability), term length (20-30 years for families), and riders (e.g., child rider $5/month per child, accelerated death for terminal illness). Purchase online or with us—application 15-30 minutes, approval 4-6 weeks (faster for no-exam). Customize with riders for OC needs (e.g., waiver of premium for disability). CA requires 10-day free look—review policy details. Add to existing coverage if needed (e.g., ladder strategy: multiple terms for layered protection, saving 10-20% per Bankrate 2025). Post-purchase: Receive policy documents, set up auto-pay to avoid lapses (grace period 31 days in CA).

Step 7: Review, Maintain, and Renew Your Term Life Policy

What to do after buying term life in Southern California?

Annual reviews with us to adjust for life changes (e.g., new baby, mortgage payoff). Maintain by paying premiums on time (grace period 31 days in CA). At term end, renew (rates higher, up to 5x per Policygenius 2025), convert to permanent, or shop new policy. For OC families, convert if health declines (e.g., post-wildfire respiratory issues). Our reminders ensure no lapses—LIMRA 2025 notes 44% feel underinsured, often from outdated policies.

Long-term maintenance:

- Update beneficiaries after events like marriage/divorce (CA community property laws apply).

- Monitor health—improvements can lower rates on new policies.

Common Mistakes When Buying Term Life in California and How to Avoid Them

What mistakes to avoid when buying term life in Orange County?

1) Underestimating coverage—use DIME.

2) Not comparing quotes—captive agents limit options; independents like us save 15-25%.

3) Ignoring health disclosures—leads to denials (rescission risk in CA).

4) Choosing too short a term—20-30 years covers child-rearing (18-22 years average).

5) Skipping riders—add child rider for $5/month.

6) Delaying due to misconceptions—costs $26/month average (NerdWallet 2025).

7) Forgetting renewal—convert before expiration if health changes.

8) Overlooking group coverage—employer plans (up to $50K free per SHRM 2025) can supplement

9) Not factoring inflation—adjust for 3% annual (BLS 2025). 10) Ignoring local risks—wildfires in OC add urgency. Avoid by consulting experts like Drew.

Term Life for Specific California Needs: Families, Seniors, and High-Risk

- For Orange County families: Cover $50K/year college with 20-year term ($25/month for $500K).

- For LA professionals: Income replacement amid commutes (universal rider for flexibility).

- For health issues: No-exam term.

- For high-risk occupations: Specialized underwriting. Customize for wildfires (riders for accelerated benefits).

- For pre-existing conditions (diabetes 12% in OC): Lenient carriers like Banner Life.

- For seniors: Short-term (10-year) for final expenses ($10K+ funerals per NFDA 2025).

Term Life Cost Table for California Residents (2025 Averages)

Based on NerdWallet, MoneyGeek, and Policygenius 2025 data for healthy non-smokers:

| Age | Gender | $500K/20-Year Monthly Cost | $1M/30-Year Monthly Cost | No-Exam Adjustment |

|---|---|---|---|---|

| 30 | Male | $25-35 | $40-50 | +20-50% |

| 30 | Female | $20-30 | $35-45 | +20-50% |

| 40 | Male | $40-50 | $60-70 | +20-50% |

| 40 | Female | $35-45 | $50-60 | +20-50% |

| 50 | Male | $100-120 | $150-170 | +20-50% |

| 50 | Female | $80-100 | $120-140 | +20-50% |

Averages; smokers 2x higher, high-risk (e.g., diabetes) 20-50% more. Factors in CA health regs. Use our calculators for personalized quotes.

Frequently Asked Questions About Buying Term Life Insurance in California

What is the best term life company in California?

Banner Life or Pacific Life for affordability and ratings (A+ AM Best 2025); we compare for you.

Do I need a medical exam in CA?

Usually for $250K+; no-exam options available up to $500K, 20-50% higher rates (Policygenius 2025).

How long does it take to get term life in Orange County?

Quotes instant, policy 4-6 weeks (faster for no-exam, 1-2 weeks).

Can I buy term life online in CA?

Yes, 32% prefer digital per LIMRA 2025—use our tools for instant estimates.

What riders should I add?

Child rider ($5/month), waiver of premium for disability, accelerated death for illness.

Term life for health issues in OC?

Yes, no-exam for diabetes (12% in OC per CDC)—we find lenient carriers.

Renew or convert at term end?

Convert to permanent if needs change; renewal rates up 5x (Policygenius 2025).

Why buy term in CA now?

Stable rates (1-3% growth per LIMRA 2025), lock in low costs before age/health changes.

How to Buy Term Life Insurance in California: A Step-by-Step Guide for Orange County Families

Secure Your Family’s Future with Term Life Insurance Today

Buying term life insurance in California, especially for Orange County families grappling with soaring living costs, mortgages exceeding $600K on average, and education expenses averaging $50K per year, is a straightforward yet essential step toward safeguarding your loved ones against life’s uncertainties.

This guide has walked you through assessing your needs with the DIME formula, exploring affordable options like level term policies starting at just $26/month, navigating underwriting and no-exam alternatives for those with health concerns such as diabetes prevalent in 12% of OC adults, and avoiding common pitfalls like underestimating coverage or delaying due to misconceptions that overestimate costs by 10x.

As an independent broker with over 40 years of expertise led by Drew W. Napolin, CLU, Pacific Direct Insurance empowers you to compare quotes from top carriers like Protective Life, Symetra, and Prudential, ensuring you get the best rates without the limitations of captive agents—saving you 15-25% on average. With trends showing a 20% surge in no-medical-exam demand and stable sales growth amid $16.2 billion in premiums, there’s no better time to act, particularly in high-risk areas prone to wildfires or LA commutes that heighten vulnerabilities.

Don’t join the 42% of underinsured Americans; take control now by getting a free quote tailored to your situation, exploring our comprehensive term life insurance services, or visiting our Orange County location for personalized advice. For more insights, check out our tools and calculators or dive into the full FAQ—contact us today at 714-941-0234 or via our contact page to start protecting what matters most.

- Why Millennials and Gen Z in Southern California Should Consider Life Insurance - January 7, 2026

- Ultimate Guide to Life Insurance in Orange County, CA: Your Path to Financial Security - August 13, 2025

- Life Insurance for Pre-Existing Conditions in Orange County, CA: Options for Diabetes, Heart Disease, and More - August 7, 2025